This week’s chart is the one I have been watching very closely the past few days and sharing in my Daily Edition. It has multiple things all going on at the same time, and presents a great lesson on a couple of important chart analysis principles.

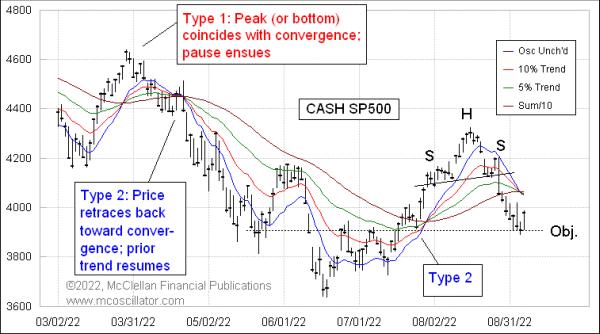

The first and more elementary point is that the S&P 500 just recently formed a classic head-and-shoulders (H&S) top structure. A H&S is important not because it is a top (or if inverted, a bottom), but because it provides us with a measuring objective for a price move once the neckline breaks. The way this principle works is that you measure the height of the head above the neckline, and apply that distance in the opposite direction from the point where the neckline gets broken, and that measurement gives the objective for the move. Here is a diagram:

If the neckline is tilted a little bit, as it is in this example, then the measurement gets just a little bit more complicated, but it is not too hard to do. In this case, the downside objective was to around 3900 on the S&P 500 Index. Reaching a H&S objective does not mean that the move has to stop; it is a target, not a floor. Its purpose is to know where to take profits on a move, if prices get there, which is also not guaranteed. There are failures to reach the objective.

In the case of the down move into September 2022, the S&P 500 met that objective pretty precisely and has now bounced. It is a fairly impressive example of this principle. And it just so happens, coincidentally, that the 3900 level, which is the H&S objective, has acted as an important support and resistance level more than once in the recent past, making it a great place to expect support to work again.

While all of this was happening, there was also the formation of what we call a “rainbow convergence” of the four moving average type lines in the top chart. Only two of these lines are actual moving averages, the 10% Trend and the 5% Trend. These are exponential moving averages, and the difference between them is the McClellan Price Oscillator. See this link for how to calculate the 10% Trend and 5% Trend.

The other two lines are more complicated, but, in my view, they are worth the trouble to calculate and include on the chart. The Price Oscillator Unchanged level represents the theoretical price where the Price Oscillator would be exactly unchanged from the day before. It acts like a fast moving average, but is not one.

The Sum/10 line is a Summation Index of Price Oscillator values, which is then divided by 10 to put it back down into the range of where prices are. It, too, acts like a moving average, a slower one, but it is not one. See this link for more on these calculations:

A convergence of these four lines is important, but its meaning varies according to how prices are behaving at the moment of the convergence. In a Type 1 rainbow convergence event, an accelerated price move serves to pull together the four moving average type lines, and the moment of the convergence marks the entry into a pause period. That pause can be just a rest break, or it can be a reversal. Which one it is depends on what prices do, and the mission of the pause is to conduct a test of the Price Oscillator Unchanged line. How that test goes determines what comes next. Seeing prices moving across the Price Oscillator Unchanged line signals a trend change or reversal. Testing and failing to penetrate it is a sign that the trend prior to the pause should resume itself.

In a Type 2 rainbow convergence, the price will retrace back toward the price-time point of the impending rainbow convergence, but not retrace beyond it. The message of a Type 2 convergence is that the trend preceding the retracement should resume itself.

It is pretty clear by now that the September 6, 2022 low was a textbook example of a Type 1 rainbow convergence. Prices bottomed on the exact day that the four moving average type lines converged. The message of a Type 1 is that prices should pause, meaning that the downtrend is on hold for a while. The mission of the pause is to make a test of the blue Price Oscillator Unchanged line, which, at the moment, is still several points above the current price level. So we should expect to see a few days’ worth of a pause in the downtrend while that test process gets worked out.

The fun part of this moment in time is that we are seeing the simultaneous completion of a rainbow convergence just as prices have pretty much exactly reached the measuring objective of the head-and-shoulders structure. Things do not always work out so neatly, but it is fun to see these rare examples when two wholly independent charting disciplines come to work together.