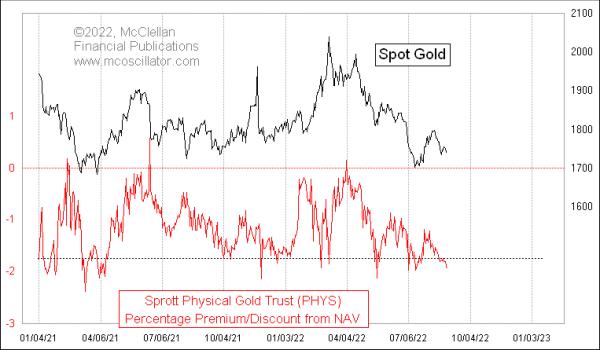

I like sentiment indicators of all types, and I like the more obscure ones even better, the kind that almost nobody watches. This week’s chart shows one such sentiment indicator for gold prices.

The Sprott Physical Gold Trust trades under the symbol PHYS, and it is a special type of investment vehicle that is different from an ETF like GLD. It does own physical gold, and has very specific rules about redeeming shares for that gold. Its shares generally trade at a slight discount to the net asset value (NAV), but that discount varies over time. You can read more at their website here.

Most of the time, the spread between the share price and the NAV is negative, meaning that you can buy the shares for less than they are actually worth. But since exchanging those shares for the actual gold is a little bit difficult, you cannot easily arbitrage that negative premium for a profit.

When gold investors are getting excited and expecting an uptrend, they get motivated by buy shares of the Sprott Physical Gold Trust. That incremental additional demand causes the share price to rise as the buyers snap up all of the available shares, and so this premium versus NAV starts to get smaller. Sometimes it even goes positive when traders get really desperate to own these shares. That is not the situation we are seeing now.

On Tuesday, Aug. 30, the discount below NAV was -1.96%, which is a pretty big negative reading. It is not the biggest ever, but it is a reading that is consistent with meaningful bottoms for gold prices. A big negative spread comes about when owners of these shares think gold is headed lower, and they get motivated to sell, so they will accept a price well below the NAV. The message is that “the crowd” thinks gold prices are going lower, and they are willing to take a big haircut just to have the privilege of getting out of these shares. That is a sign that sentiment toward gold is pretty washed out, befitting a bottoming condition for gold prices.

You can track this data yourself at this link.