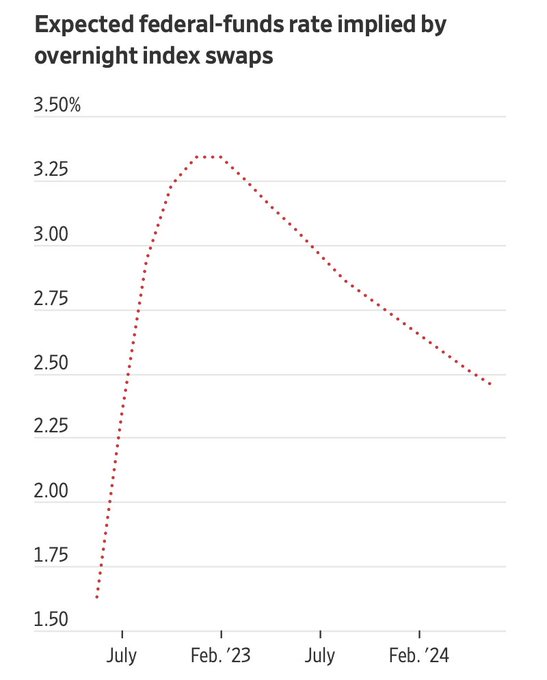

The chart posted is all about expectations.

Regardless of the talk on the new and stretched definition of recession, departing from the textbook definition, investors believe that the Fed Funds rate is close to peaking and will begin to decline into 2023 and 2024. Incidentally, I wrote a daily on June 28th addressing this topic. I do remind readers of the textbook definition. I also remind readers why one could stretch the definition by observing this:

“Granny Retail (XRT) is not bullish, but she is holding steady and still taking money out of her purse. For the middle class, upper-middle-class and wealthier folks, luxury vacations due to pent-up demand are still in style and, for many hard-working Americans, her purse strings are being spent out of necessity for items like food.”

Jerome Powell quietly stated that this week’s meeting could see a 50 bps raise, rather than the 86% consensus that it will be 75 bps. Furthermore, he said that he expects to be less aggressive going forward.

However, will 3% yields or even 3.25% be enough to stave off inflation? And what will happen to the market even if inflation has plateaued, rather than peaked?

Why won’t anyone say “stagflation”, the most accurate term to describe the current economic macro?

Over the weekend, I included 6 logical reasons to support why stagflation is a word that could tell investors where to put money. If one follows the logical path, we can assume a few things:

Yields remaining around 3% will not impact a 9.1% inflation rateA weaker dollar will not help reduce inflationWith nary a recession (strong labor, ok housing market) nor economic growth (earnings mixed, reduction in corporate spending) in the near future, stagflation is the economic themeThe war in Russia-Ukraine is not endingOil supply remains lowChina, still somewhat asleep, has yet to emerge hungry for raw materials

Hence, we watch a few key indicators this week.

First, watch the yields and the high grade plus high yield bonds. (LQD red but still in good shapw; HYG even stronger than LQD, which makes sense given how many tech companies will report earnings). If LQD and HYG remains firmm that suggests more risk-on.

Secondly, watch the consumer discretionary sectors. We need to see the consumers stay in the game. To date, Granny Retail XRT is off the highs, yet holding above the key 200-week moving average. Also watch the dollar and the gold market; if gold continues to hold the major multiyear support, then we’ll see a big gold rally coming.

Finally, watch the oil and energy market. Should crude oil join natural gas in a new bull run, commodities will soar while equities will suffer.

Putting this all together, the market is in a trading range. The yields are not expected to go much higher. Commodities are in support zones and one catalyst, geopolitical or environmental, can take prices way higher.

Consumers are still out there. Housing has softenend but hardly collpased. And, speaking of new definitions, the labor market is strong while job openings are high and folks continue to quit their jobs.

What does that sound like to you? Seriously. We want to know.

Recession is pointless to debate, even the textbook definition could be manipulated (nominal GDP or real GDP). We will also watch earnings for more indications.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

In this appearance on BNN Bloomberg, Mish explains why commodities could have a second run higher, and what we can expect from the equities market.

Mish discusses the term “stagflation” in her latest appearance on Neil Cavuto’s Coast to Coast on Fox Business.

Mish talks about the current rally and how retail is key to its continuation or failure on Making Money with Charles Payne.

ETF Summary

S&P 500 (SPY): 403 big resistance, 390 supportRussell 2000 (IWM): 176.50 support to hold; now must take out 182.50Dow (DIA): 322-323 resistance, 316 support Nasdaq (QQQ): 308 big resistance ,293 supportKRE (Regional Banks): 60 key supportSMH (Semiconductors): 221 support, 230 resistance IYT (Transportation): 221 supportIBB (Biotechnology): Support 120XRT (Retail): 62.90 pivotal or the 50-DMA

Mish Schneider

MarketGauge.com

Director of Trading Research and Education